Business

Business: 01

Real Estate Business

New built-for-sale condominium

Business Overview

The new built-for-sale condominium business, which we have developed across Japan through an integrated system covering everything from the acquisition of land to product planning and sales, is a core business accounting for more than half the units we sell on a consolidated basis. This business includes the mainstay LEBEN brand, which focuses on first-time home buyers, while the NEBEL series offers compact condominiums in urban areas. In the Tokyo metropolitan area, we mainly focus on units for single-family, single-person, and double income no kids (DINKs) households, and in regional city centers we concentrate our efforts around housing for active seniors.

Review of FY2024

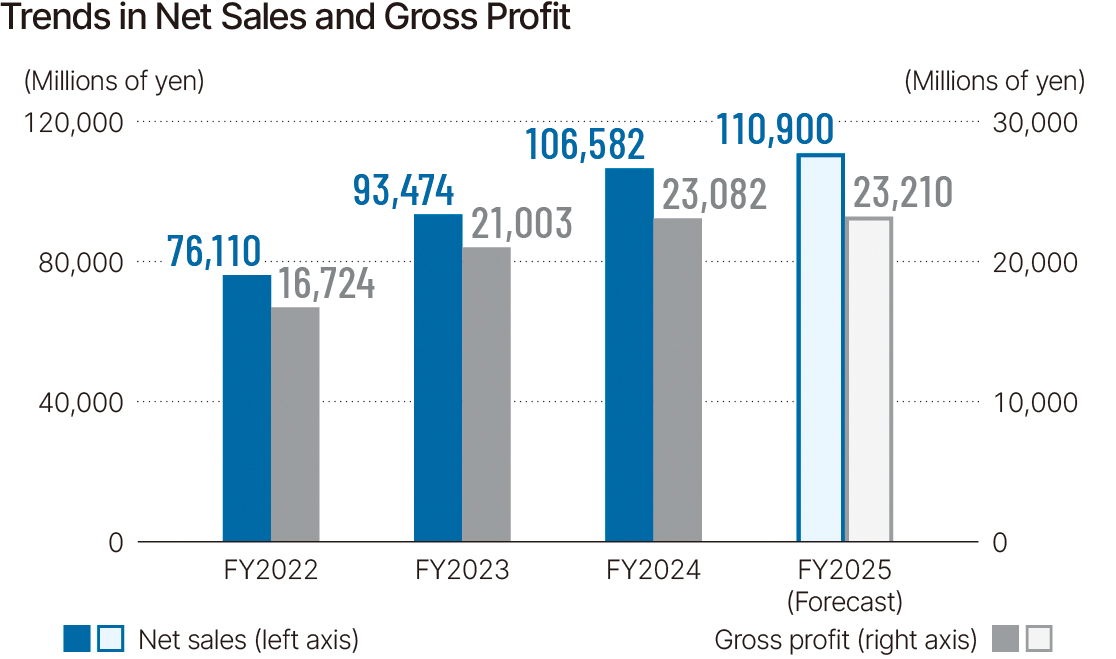

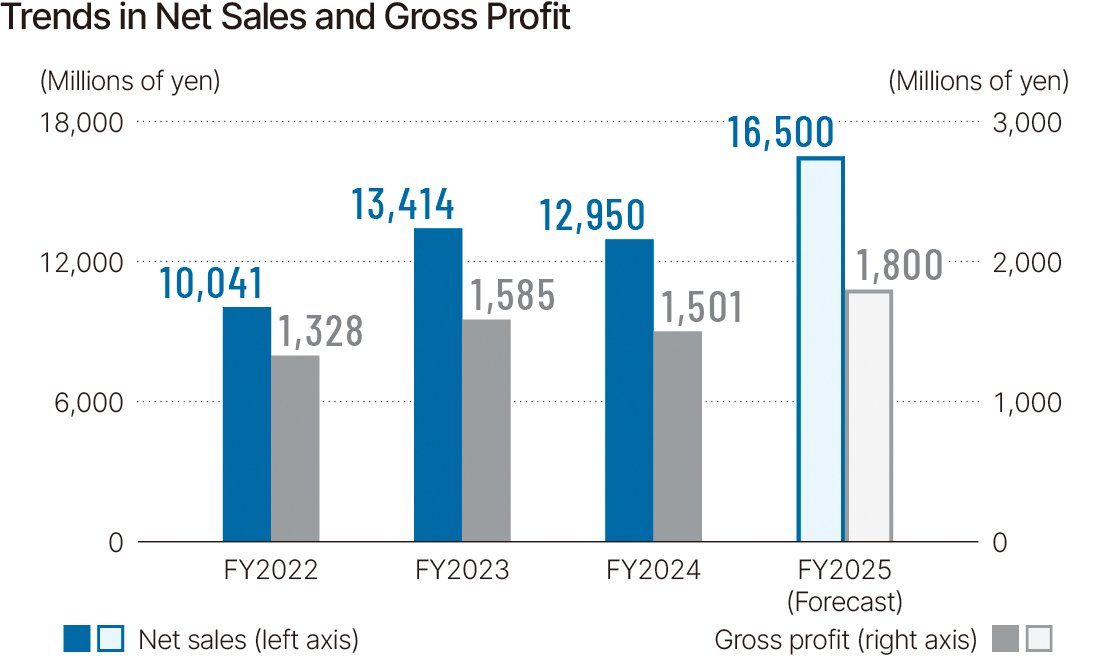

For FY2024, the new built-for-sale condominium business

recorded net sales of ¥106,582 million (up 14.0% from the previous

fiscal year) and gross profit of ¥23,082 million (up 9.9%). The

gross profit margin fell to 21.7% (down 0.8 percentage points),

exceeding the initial plan by 0.9 percentage points. The new builtfor-

sale condominium business thus continued to play its role as a

core business for the Group, accounting for 54.2% of company-

wide sales and 54.6% of total gross profit.

The number of new built-for-sale condominiums sold stood at

2,339, an increase of 125 units from the previous year, marking a favorable shift. Steady progress was made on regional efforts to

strengthen the brand, and the business was able to maintain its

profit margin at a high level.

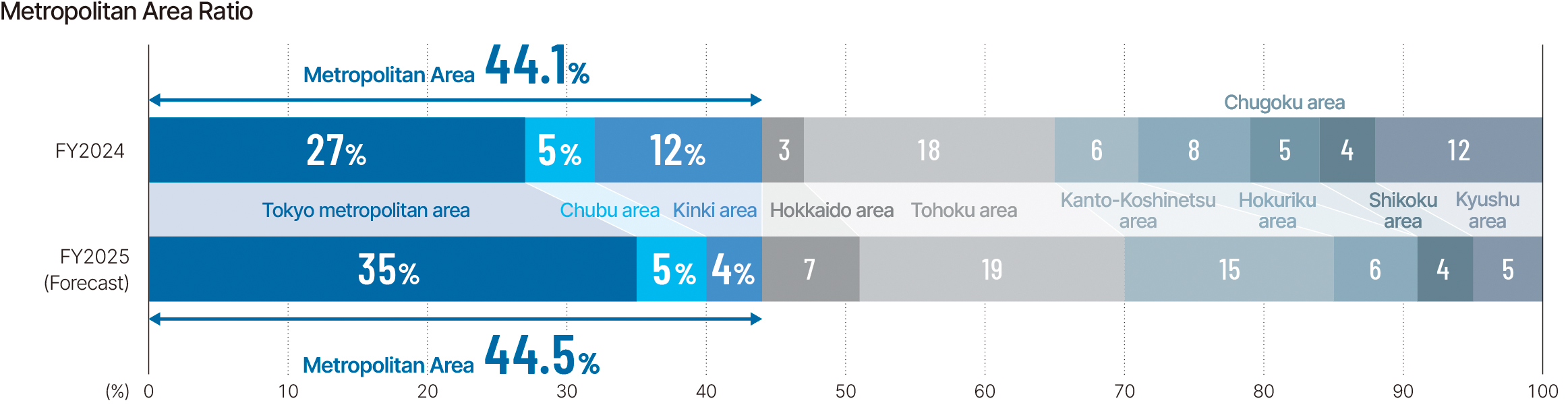

The Company provides units across the country, from

Hokkaido to Kyushu, with the 27% of units being supplied to the

Tokyo metropolitan area, and the Chubu area and Kinki area

accounting for 5% and 12%, respectively. Together, these three

metropolitan areas accounted for 44.1% of units supplied, up 9.9

percentage points from the previous year, with higher results in

the Kinki area in this period being of note.

Future Initiatives

Amidst a procurement environment where there have been sharp

increases in material costs as well as an acute labor shortage

causing similar increases in construction costs, sales prices in the

new built-for-sale condominium market have also trended

upward. On the other hand, real estate demand continued to

reflect customers’ high and persistent willingness to purchase

residences. As of the first quarter of FY2025, delivered units for

the entire fiscal year are projected to reach 2,820 units, with contracts

already finalized for 1,349, or 47.8%, of these units. This

means net sales are estimated to grow to ¥110,900 million, with

gross profit growing to ¥23,210 million.

In the domestic market, where population is increasingly concentrated

in the Tokyo area while regional cities face declining populations, we predict that the ratio of buildings in metropolitan

areas will grow to 44.5% (up 0.4 percentage points) in FY2025.

As for such issues as lengthening construction periods and

sharply increasing construction costs, we are responding through

cost controls, time controls, and high product standards. At the

same time, we have a policy of striving to maintain desirable price

levels as a partner for first-time home buyers.

With the number of domestic households continuing to decline,

it is estimated that the number of condominium units supplied will

fall as well. To sustain growth in such an environment, we make

careful selections when acquiring land and will provide our target

customer groups across Japan with more appealing condominiums

that are carefully designed to meet their needs.

Liquidation

Business Overview

The liquidation business is our second pillar of earnings in the Real Estate Business. This business draws on expertise cultivated within the new built-for-sale condominium business to help develop our diverse array of real estate assets. Specifically, this includes the high-grade rental condominiums “LUXENA” as well as residences, office buildings, and hotels. We have sold 60%– 70% of the properties developed to date to Takara Leben Real Estate Investment Corporation and support the company’s external growth.

Review of FY2024

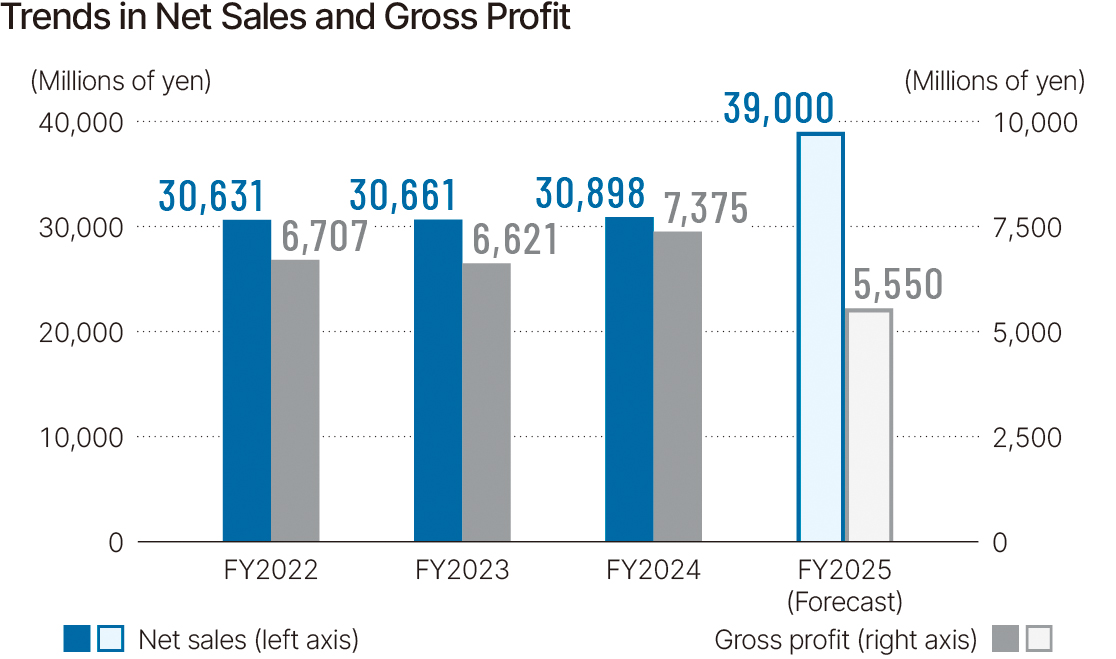

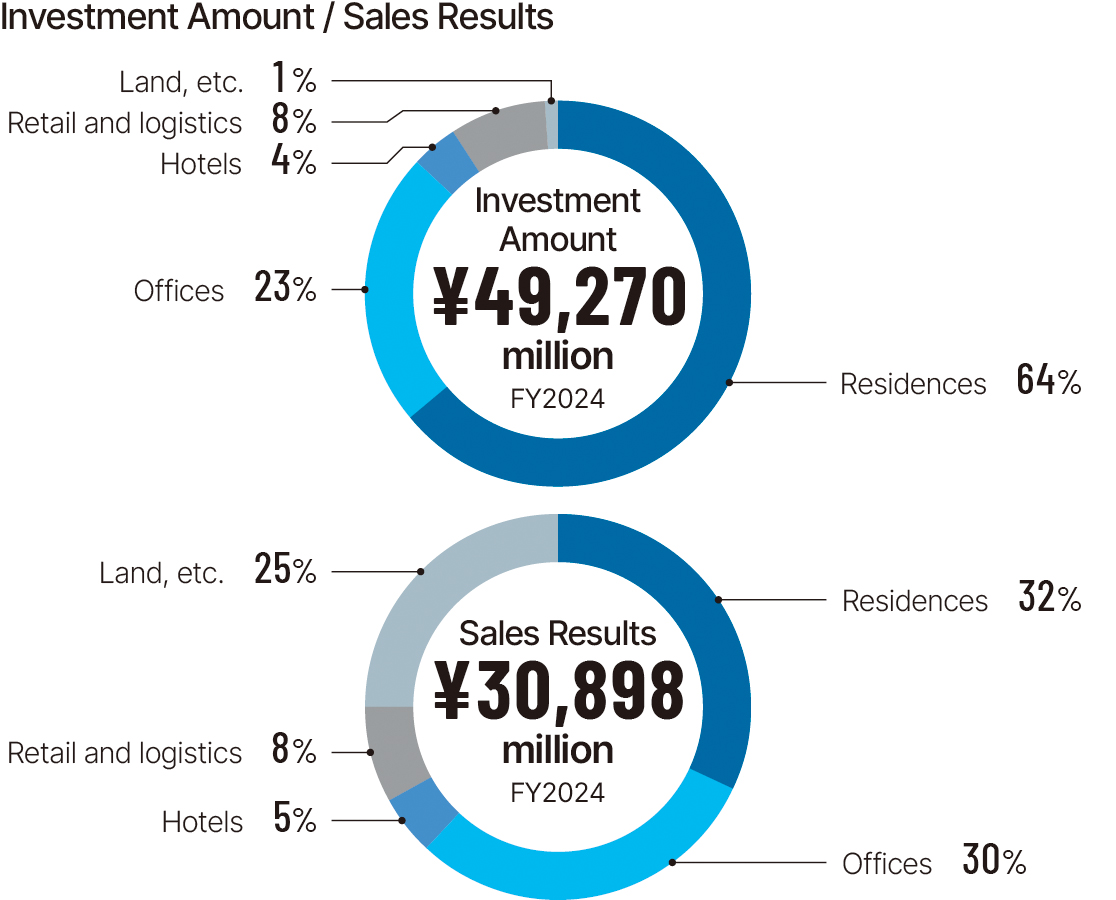

As the market environment continues to be sound, beneficial

contributions from newly developed residences led to gross profit

of ¥7,375 million, which was 19.0% higher than initial targets.

We also promote the development of new products centered

on the LUXENA series, such as “LUXENA+ OTO MINAMI-SENJU,”

which was created to meet the demand for soundproof facilities.

In addition, steady progress has continued in efforts to increase

the value of our owned real estate and around leasing.

The amount we invested nearly doubled compared with the

previous period, growing to ¥49,270 million, due to the acquisition

at locations around Japan of superior assets matching

our investment standards.

We marked strategic progress by taking advantage of opportunities

provided by a sound real estate market, resulting in sales

increasing to ¥30,898 million. The gross profit margin improved far

beyond the initial target of 17.2% to 23.9%, contributing to stable

profit across the entire Group.

Future Initiatives

We will continue to actively acquire and develop assets nationwide.

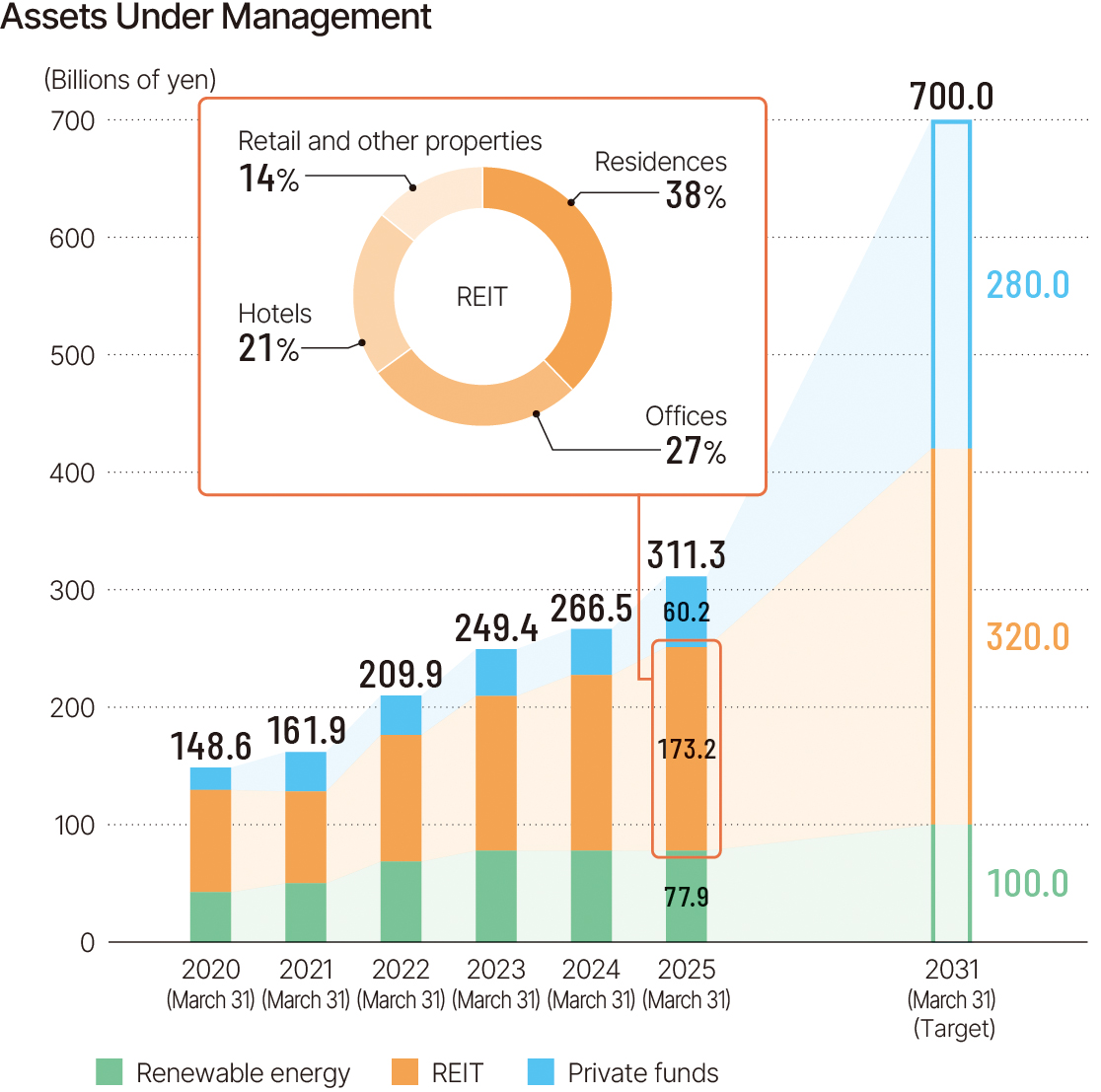

To achieve the targeted level of expansion in the Takara Leben Real

Estate Investment Corporation’s asset scale, that is, increasing it

from the current ¥173.2 billion to ¥320.0 billion by March 31, 2031,

we strive to accurately assess demand in each area and carefully

select and secure investment opportunities.

With a focus on market trends, we will also challenge ourselves

to develop new concept products.

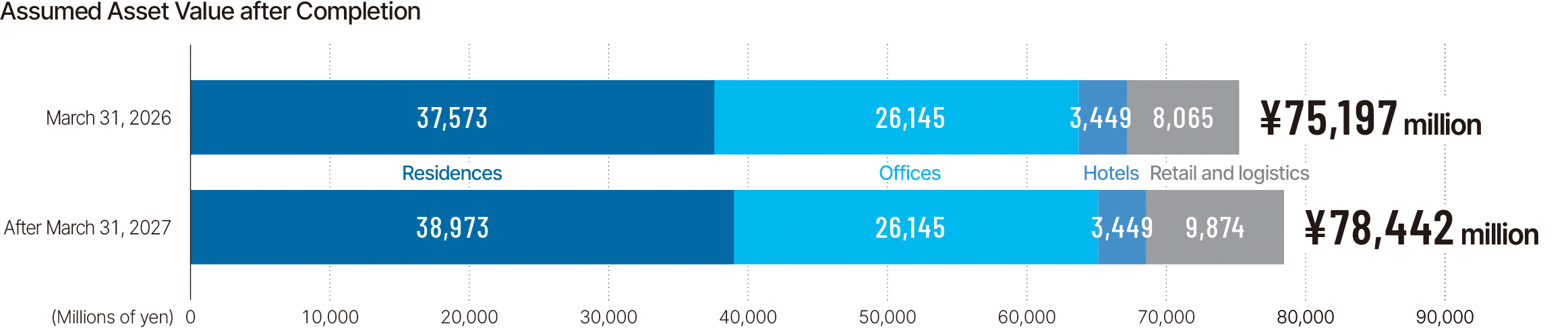

Regarding asset scale, as of March 31, 2025, we are holding

¥45,109 million* in assets in addition to owned assets undergoing

development that are valued at ¥17,704 million. The projected

value of these assets once development is completed is ¥33,333

million. Combined with existing assets this will bring total assets

held to ¥78,442 million. * Includes assets for liquidation that are included when calculating total real estate for sale

New detached house

Business Overview

Through Leben Home Build, we have established an integrated system in the new detached house business covering development, construction, and sales. At quality sites that are selected based on our own high standards—covering such factors as lifestyle convenience, educational environment, natural environments, and accessibility—we provide mainly mid-priced 4LDK residences. We also offer an expansive array of after-sale services and extended warranties that enable us to achieve the dual goals of offering “the ideal home that anyone can purchase affordably and with peace of mind” and “high quality at an accessible price point.”

Review of FY2024

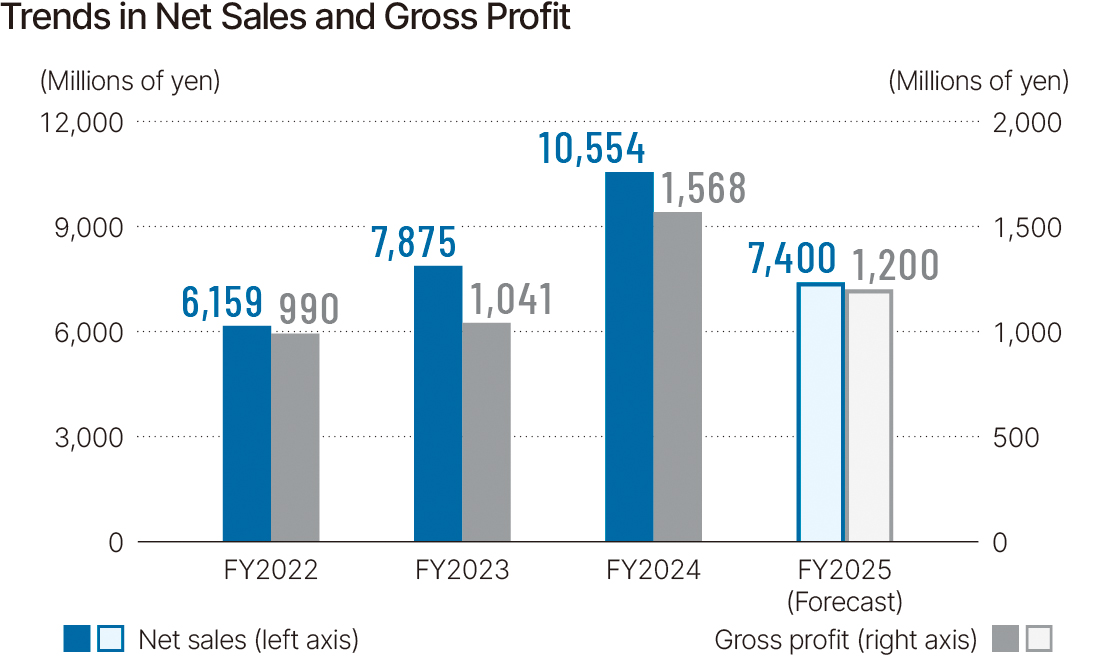

Although only 217 units were sold, fewer than the 230 units

initially

planned, we saw progress generally in line with our plans.

Gross profit amounted to ¥1,501 million while the gross profit

margin came to 11.6%, both falling short of initial plans.

During the fiscal year, we promoted strategies aimed at

improving the synergistic effects of our brand and deepened

regional cooperation via business development in areas in and

around which the Group supplies condominiums.

Future Initiatives

We are working to distinguish our new detached houses business

from those of other companies by focusing on particular areas

when developing homes and applying a community-rooted

approach, with efforts centered on our LEBEN PLATZ series.

We are aware of the need to improve our market analysis capabilities

for individual areas; our hybrid investment strategies

designed in accordance with scale; and the structure of teams

that handle the execution of such strategies. By continuing to

enhance business development that accounts for regional

characteristics,

we seek to create stable, long-lasting structures

for supplying housing.

Renewal and resale

Business Overview

In the renewal and resale business, we focus on Tokyo and its three neighboring prefectures. We purchase second-hand condominium units that are about 30 years old with about 60 square meters of floor space to meet the needs of customers for preowned properties in highly convenient and favorable locations. Then, after the tenants have moved out, we renovate and resell them. We are also developing the Lé Art brand, where we acquire entire condominium buildings secondhand and utilize our design and planning capabilities to renew them.

Review of FY2024

Profitability improvements allowed us to surpass initial targets for total gross profit of ¥1,568 million. We have set the standard for average prices in each area, and efforts to raise the value of buildings to the level of “near newly built” have contributed to business performance. The gross profit margin was 14.9%, 2.5 percentage points better than initially planned.

Future Initiatives

At present, we do not expect a reccurrence of the bulk sales of multiple buildings seen in the first half of FY2025, so net sales are projected to fall. Because the price of purchases in the secondhand condominium market is continuing to rise, we are carefully proceeding with building acquisitions while paying close attention to the profitability of each property.

Real estate rental

Business Overview

The rent generated from properties the Group owns is the real estate rental business’s main source of income, and around 90% of these properties were acquired by the liquidation business or the renewal and resale business for the purpose of securing a lineup for the future. This business is also actively acquiring rental properties across Japan while striving to maintain high occupancy rates. Operations such as those related to rental property tenant acquisition are handled mainly by Leben Trust.

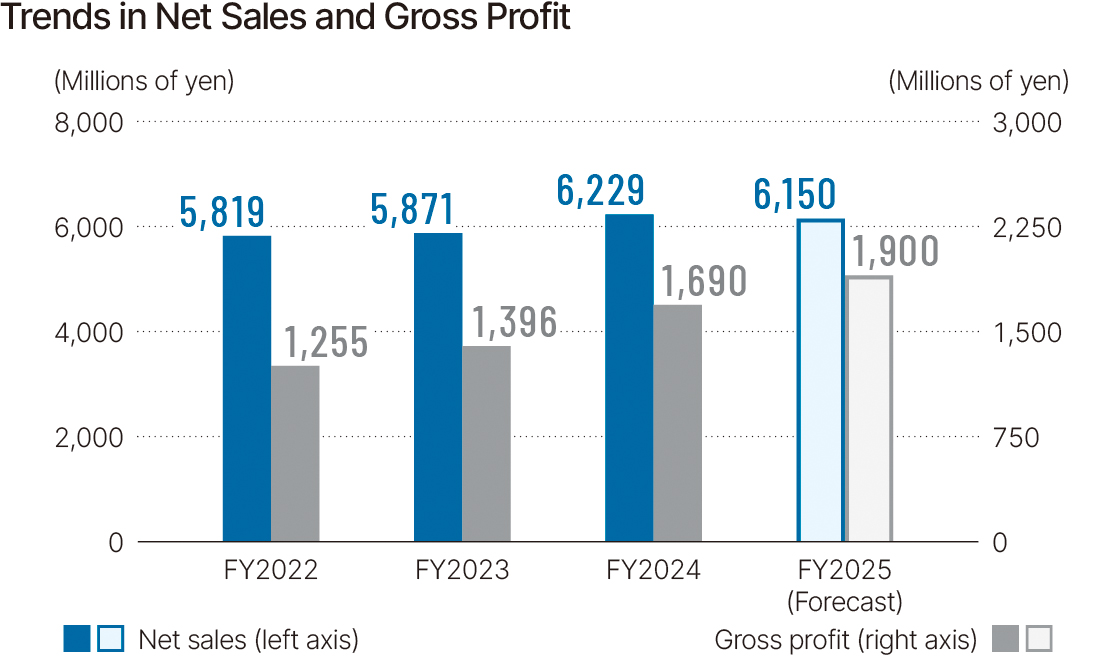

Review of FY2024

Soundness in rental apartments and office buildings markets led

to net sales of ¥6,229 million with a gross profit margin of 27.1%,

showing results that exceeded initial plans.

Inflationary trends in rent combined with enhanced occupancy

rates for our owned properties over long periods allow us to

steadily promote internal growth.

Future Initiatives

We will continue to supply products in exceptional locations centered on our specialty of floor plans for units sized 165 to 330 m2. In addition, we seek to further secure income by strengthening profitability through the enhancement of the value of currently held buildings (promoting internal growth) as well as by pursuing strategic asset exchanges in accordance with the market environment.

Real estate management

Business Overview

We manage a wide array of real estate assets, such as condominiums, rental residences, and office buildings, with Leben Community at the center of such efforts. Leben Community provides optimal management services ranging from everyday upkeep and maintenance to the planning of long-term repairs, building inspections, and proposals for large-scale repairs while maintaining dialogue with co-owner associations.

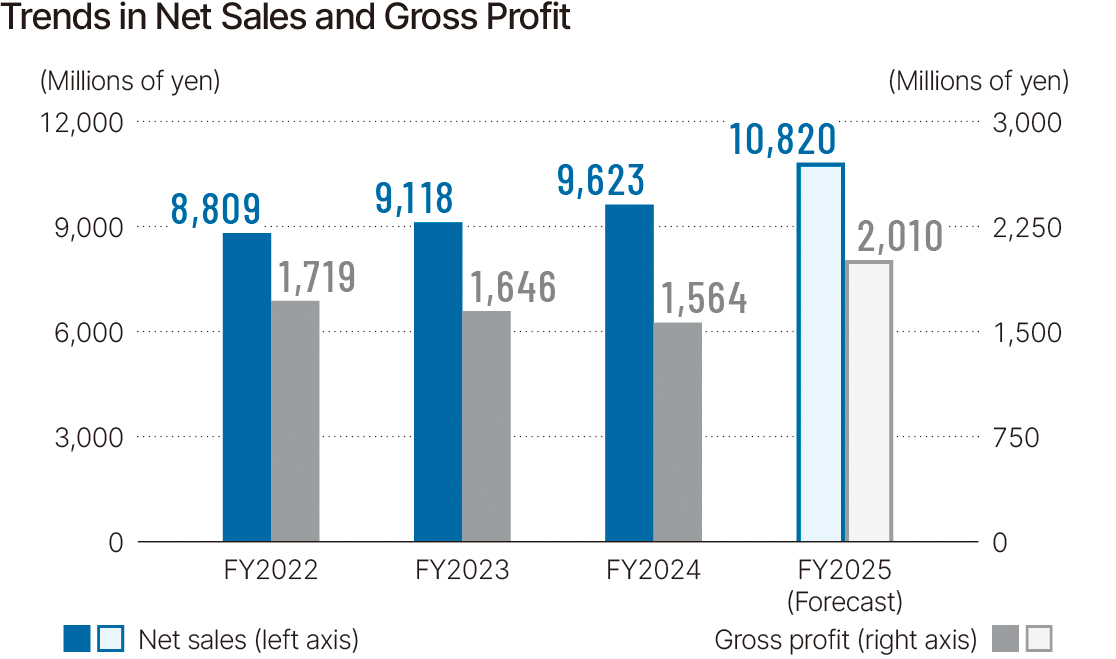

Review of FY2024

The gross profit margin declined slightly amid a rise in personnel

costs. Falling short of initial targets, the number of housing units

managed was 79,624, net sales were ¥9,623 million, and the

gross profit margin was 16.3%.

Although profitability was impacted by rising costs, the number

of housing units managed increased by 2,963 compared to the

previous period and the business base continued to steadily

expand. We expect to see measures to reduce costs and make

management costs more reasonable to begin yielding results

after FY2025.

Future Initiatives

Personnel costs appear to be continuing to rise, and we recognize

that enhancing management services and reducing costs are

both important management issues towards ensuring suitable

rates of profit.

High quality service capabilities secured through the provision

of training and certification systems is one of the Company’s

fortes. Through measures that include regular training and proficiency

tests, we have strengthened condominium managers’

business skills and ability to serve customers. We will further

refine our initiatives to educate human resources to enhance both

customer satisfaction and profitability.

Real estate and other

Business Overview

In the real estate and other business, we mainly provide real estate distribution services that include acting as an intermediary or sales agent when real estate is bought and sold. This entails utilizing our expertise and informational capabilities to formulate the most suitable proposals to meet the diverse needs of customers and may include anything from determining contract terms to organizing handovers. Our ability to utilize both our customer base and wealth of knowledge pertaining to buildings that we have gained through our various other businesses, in such areas as properties for sale, managed properties, and rental properties developed by the Group, comprises a huge point of strength within the industry.

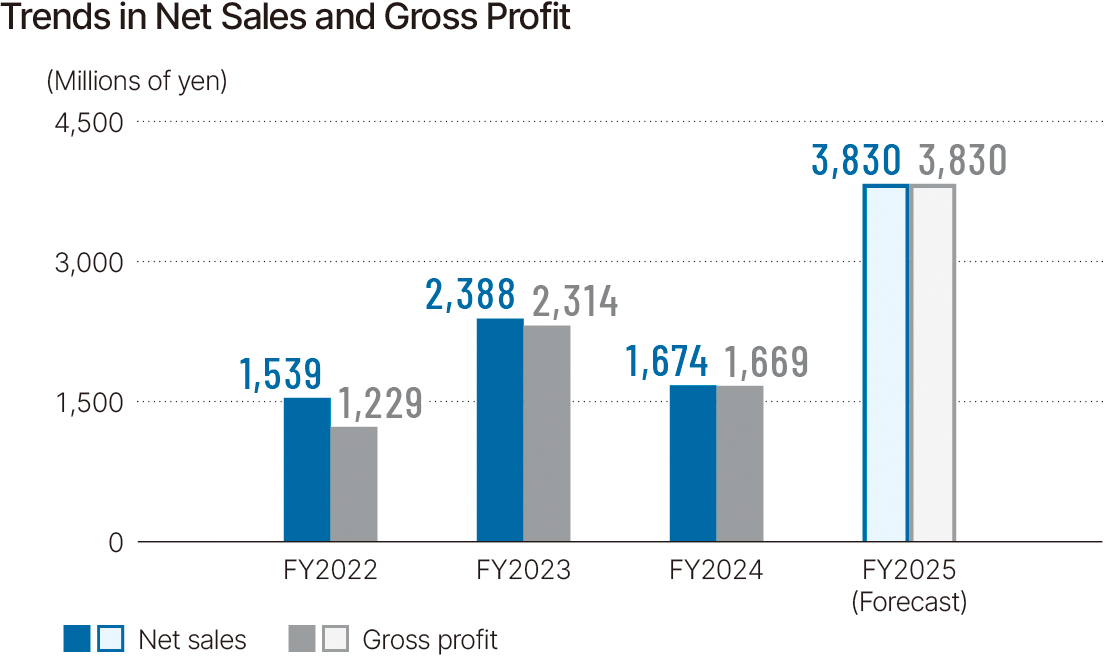

Review of FY2024

Net sales rose to ¥1,674 million, 23.1% above the initial target, while the gross profit margin was 99.7%, 0.3% below the initial target. Despite these results being down from the previous fiscal year, we saw sound progress in terms of initial targets.

Future Initiatives

We will continue to utilize Group assets to their fullest extent as we strive for stable growth as a fee business. In FY2025, we expect that income from fees collected through acting as a sales agent will increase due to a higher number of joint ventures (JVs) in the new built-for-sale condominium business, and net sales are expected to expand by a factor of roughly 2.3 times from the previous fiscal year.

Business: 02

Energy Business

Business Overview

With operations centered on MIRARTH Energy Solutions, we promote the development and sales of electricity produced by power plants that utilize solar energy, wind, or other such renewable energy resources along with the operation and maintenance of such facilities, as well as biomass fuel conversion using cashew nutshells. In addition to the stable profit generated through the Feed-in Tariff (FIT) system, we are actively pursuing the expansion of these businesses through Power Purchase Agreements (direct energy purchase contracts with such entities as corporations or municipal governments) as we seek further growth in what has become the second pillar of our main business efforts after the Real Estate Business.

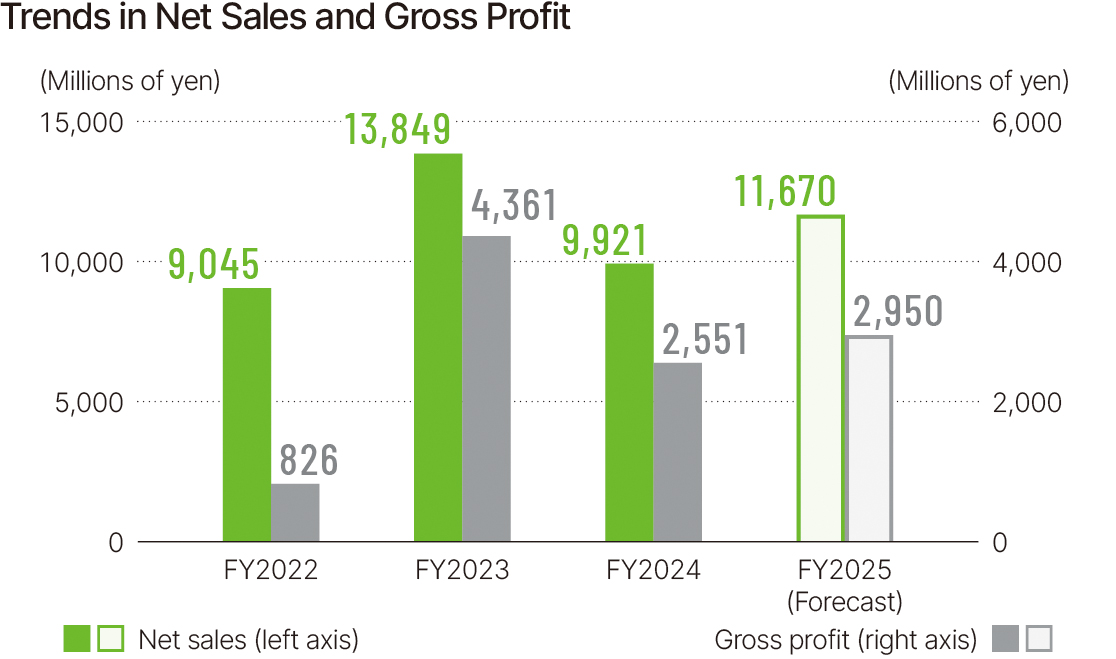

Review of FY2024

In FY2024, net sales fell by 21.9% from initial targets to ¥9,921

million while gross profit fell by 42.4% from initial targets to

¥2,551 million due to the considerable impact of a halt in sales

of power plant facilities. Factors that caused power sales to fall

short of plans included costs incurred in taking measures

against cable theft and repairs, but as these are temporary

effects we expect profitability to improve in FY2025.

On the other hand, power generation capacity expanded to

385 MW as of March 31, 2025, and we are making steady

progress. We are also currently expanding our portfolio with the goal of securing stable power sources, having acquired

the Hokkaido Otobe Power Plant (a wind energy plant) in

December 2024. This has given us a new power source that

is effective in the winter, when solar energy efficiency drops.

MIRARTH Energy Solutions has also entered into an on-site

Power Purchase Agreement (PPA)* with Yamanashi

Prefecture as of January 2025, as well as with the city of

Sapporo in February of the same year. Through these initiatives,

we continue to create a non-FIT business model.

* A contract for providing renewable energy generated within sites where there is demand

Future Initiatives

For FY2025, we do not anticipate any facility sales and will

focus on expanding our power generation capacity. For our

operational power generation capacity, we expect an increase

of 25 MW compared to FY2024, reaching 410 MW. We project

net sales of ¥11,670 million and gross profit of ¥2,950 million .

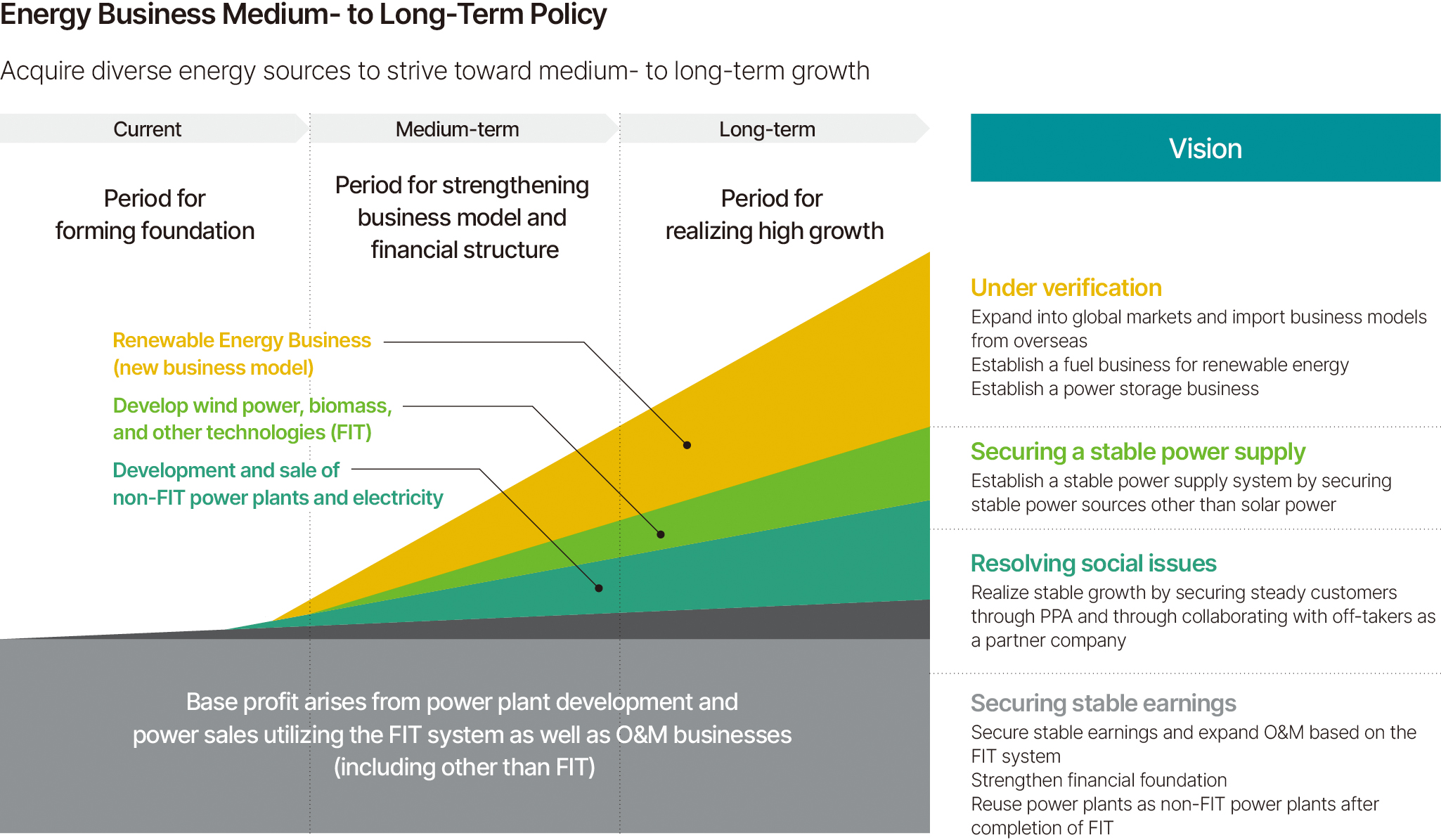

MIRARTH Energy Solutions is creating medium- to longterm

business plans and is enhancing its ability to generate

profits. We will actively invest in power storage sites and

accelerate our power facility development, with efforts

centering

on solar power plants. In addition, we will also seek

growth in new areas, including our cashew and fuel businesses.

As even comparatively cramped power storage sites can be

highly profitable, we will utilize the network we have cultivated

in our Real Estate Business to acquire land and optimally

distribute

the sites where such facilities are built.

In addition, in line with efforts to diversify our energy

sources,

we create a biomass power plant that uses wooden

chips as fuel. Compared with solar power facilities, the operation

and maintenance of biomass power generation facilities

is more difficult, and we are strengthening systems in pursuit

of stable operations.

Regarding the cashew and fuel businesses, we completed

construction of a cashew nut processing plant in Cambodia in

June 2024. Products manufactured at this site have been rated

highly, and we will continue with efforts that include the expansion

of processing and the cultivation of technical knowledge.

The 6th Strategic Energy Plan published by the Agency for

Natural Resources and Energy contains a policy to have

renewable energy account for 36%–38% of the energy generated

in Japan by 2030, and the Group recognizes this as an

opportunity for growth. As such, the Energy Business has

been positioned as our second pillar after the Real Estate

Business, and we will strive to expand business areas and

strengthen profitability.

Business: 03

Asset Management Business

Business Overview

Utilizing the wealth of expertise, knowledge, and networking capabilities regarding real estate and renewable energy accumulated by the MIRARTH HOLDINGS Group, we actively manage J-REITs and private funds. The Asset Management Business is handled by MIRARTH Asset Management and MIRARTH Real Estate Advisory. We respond to the diverse needs of investors by properly handling the unique attributes of specific investments as well as by providing them with excellent investment opportunities.

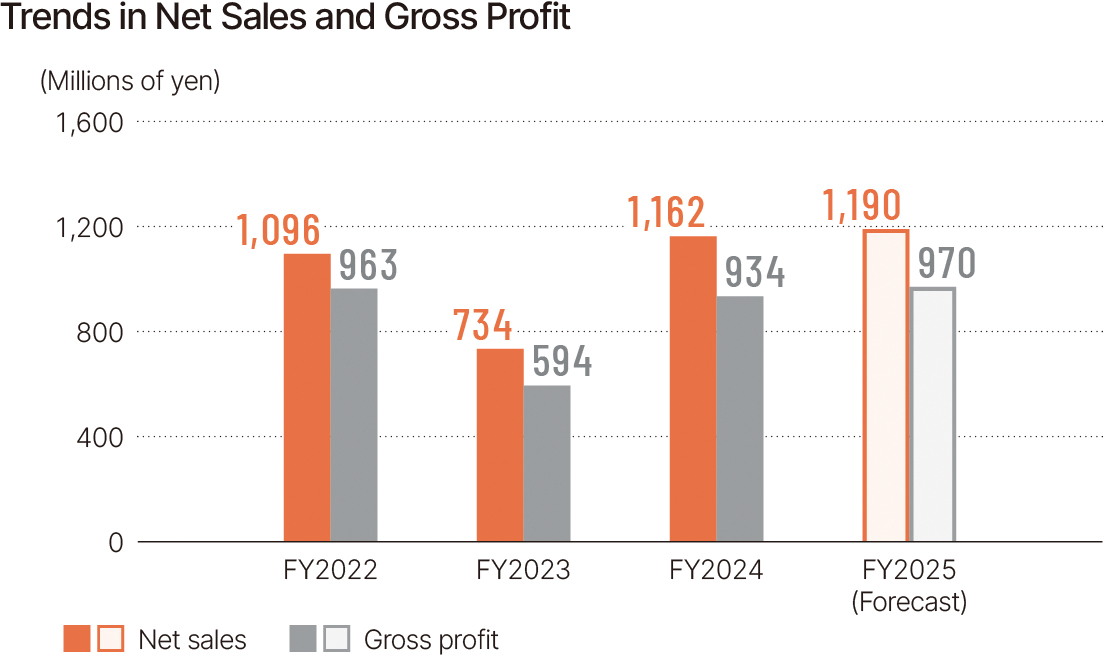

Review of FY2024

In FY2024, the formulation of a private fund greatly drove

performance, with net sales reaching ¥1,162 million, up

29.2% from the initial target. At ¥934 million, gross profit also

grew, up 33.5% from our initial target. Thus, performance

outstripped

plans by a wide margin.

In addition to expanding building acquisitions, we followed a

strategy of turning over assets through timely sales, leading

to steady growth.

The appetite for investments in Japanese real estate was

strong both at home and abroad, and performance remained

favorable thanks to a sponsor system that utilized the Group’s

planning capabilities along with our steady building procurement

capabilities. Through careful investments undertaken

with an eye to maintaining high levels of diversity in tenants

and high asset value in individual buildings, we continued to

acquire new buildings.

Assets under management (the value base for acquisitions)

totaled ¥311.3 billion, achieving the previous Medium-Term

Management Plan goal of ¥300.0 billion assets in assets

under management. This total breaks down into ¥77.9 billion

related to renewable energy, ¥173.2 billion related to REITs,

and ¥60.2 billion in the private fund.

Future Initiatives

We will continue striving to expand assets under management

and achieve steady internal growth as we strengthen

our management systems. A robust organizational foundation

is paramount when expanding assets, and the creation of

favorable office environments becomes an important issue

when securing and integrating exceptional human resources.

We believe that securing these human resources is as

important

as acquiring buildings, and we are focusing our

efforts on this goal.

Regarding capital increases, we are aware that there is an

impact on net asset value (NAV), but we adhere to a policy of maintaining a certain dividend level regardless of NAV.

As an investment manager, we are aware of our duty of

care and endeavor to ensure that our investment decisions

are well-considered and prudent. To this end, we conduct

careful examinations from the perspectives of profitability and

asset value before investing in properties projected to see

high levels of internal growth. This business’s duty is to

increase asset value through higher rents and enhanced

building values, and we will continue to contribute to the

growth of the Group’s stock fee business.

Business: 04

Other businesses

Business Overview

Group companies are involved in a wide array of other businesses,

such as the hotel business, the construction

business, and the caregiving business. In addition, the construction

business implements strict quality management

systems, including internal inspections of various processes

across multiple levels, and provides buildings for such various

uses as apartment complexes, welfare facilities, and retail

facilities.

Moreover, in the hotel management business, we

draw on the Group’s housing creation expertise and apply

knowledge related to comfortable spaces to the development

of the unique “HOTEL THE LEBEN” brand. In these and similar

ways, we seek to create new value by taking on the challenge

of expanding into new fields.

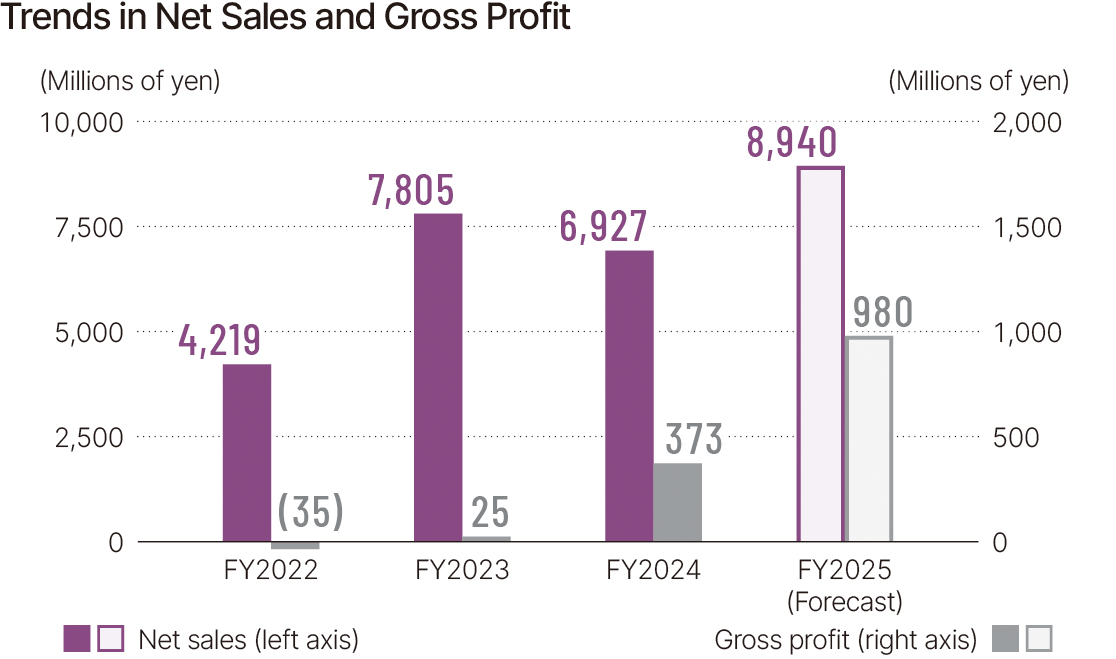

Review of FY2024 and Future Initiatives

Profit from other businesses was attributable to efforts

including construction contracts, hotel management, and

rehabilitation/day care services. Due to these efforts, net sales

amounted to ¥6,927 million (4.3% below the initial target) while

gross profit amounted to ¥373 million (58.9% below the initial

target).

Profitability was impacted due to rising costs in construction

and nursing care businesses, but the operation of our

managed hotels has produced favorable results, with gross

profit rising ¥348 million above that of the previous fiscal year.

We also received high ratings, including the acquisition of a

Michelin Key for our Nasu mukunone project in July 2024.

We expect occupancy rates and individual room prices

to remain high in our hotel management efforts and aim to

further enhance profit ratios. Strategies toward this end include accelerating the development of hotels specializing in

lodging accommodations as well as improving operations and

enhancing profitability among our existing hotels. We are also

promoting efforts to take charge of managing the hotels of

other companies as well as expanding the scale of our management

efforts, including via M&As. Through these efforts,

we aim to achieve an operating profit of ¥1 billion in FY2030.