Value Creation & Materiality

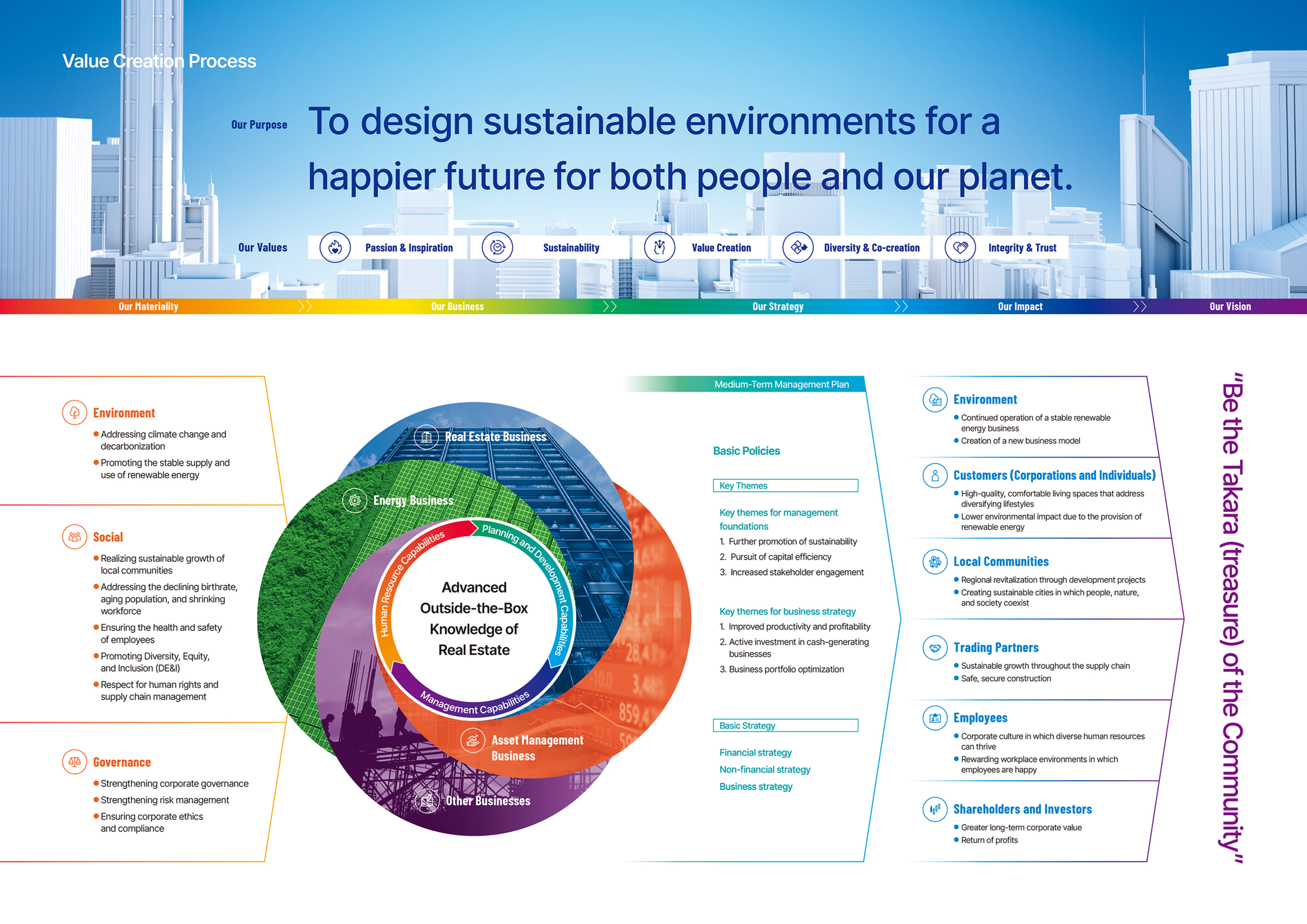

Value Creation Process

The MIRARTH HOLDINGS Group aims to evolve into “a company that makes people and our planet happy in the future” by applying the three types of knowledge cultivated in the real estate business to the energy business and asset management business, and by creating synergies across business fields among group companies.

Important themes and materiality

Environment

Realizing a Decarbonized Society

While working to ensure a stable supply of renewable energy, we aim to promote environmentally friendly development with a low environmental impact by incorporating energy conservation measures and strive to mitigate climate change issues.

- Addressing climate change and decarbonization

- Promoting the stable supply and use of renewable energy

Governance

Strengthening Governance

We aim to fulfill our corporate social responsibility by promoting sound corporate activities and ensuring transparency in decision-making, and to continuously enhance our corporate value.

- Strengthening corporate governance

- Strengthening risk management

- Ensuring corporate ethics and compliance

KPI Targets and Results

Environment

Addressing climate change and decarbonization

| KPI | FY2024 | FY2025 | |

|---|---|---|---|

| Target | Result | Target | |

| CO2 emission reduction rate (Scope 1, 2 and 3) | 45% *1(vs. FY2022) | Scope 1, 2: 41% Scope 3: ▲18% |

45% *1(vs. FY2022) Scope1,2: 70% Scope 3: 45% |

| Number of internal initiatives contributing to energy conservation | 10 | 14 | 10 |

| Active development of renewed/renovated condominiums | 〇 | ||

- *1 Set as a mid-term target through FY2030.

Promoting the stable supply and use of renewable energy

| KPI | FY2024 | FY2025 | |

|---|---|---|---|

| Target | Result | Target | |

| Total renewable energy generation capacity | 780MW *2 | 385MW | 410MW *3 |

| Acquisition of environmental performance certification | 5 buildings | 9 buildings | 5 buildings |

| Adoption rate of ZEH standard in detached houses *4 | 100% | 100% | 100% |

| Promoting the use of renewable energy in the business of newly built condominiums for sale | 〇 | ||

- *2 MW figures based on solar power equivalency; set as a medium-term target through FY2030 (ending March 2030).

- *3 KPI revised to "Cumulative Operating Power Generation Capacity of Renewable Energy Facilities."

- *4 Houses certified as Grade 5 for insulation performance and Grade 6 for primary energy consumption, excluding renewable energy standards.

Governance

Strengthening corporate governance

| KPI | FY2024 | FY2025 | |

|---|---|---|---|

| Target | Result | Target | |

| Evaluation of the effectiveness of the Board of Directors | 〇 | ||

| Consideration of introduction of clawback provisions | 〇 | ||

Strengthening risk management

| KPI | FY2024 | FY2025 | |

|---|---|---|---|

| Target | Result | Target | |

| Verification and management of critical risks | 〇 | ||

| Formulation of BCP manuals | 〇 | ||

Ensuring corporate ethics and compliance

| KPI | FY2024 | FY2025 | |

|---|---|---|---|

| Target | Result | Target | |

| Providing compliance education | 3 times/year | Conducted 5 times | 3 times/year |

| Compliance questionnaire for all employees | Once a year | Conducted once | Once a year |

| Awareness rate of whistleblower system | 100% | 97% | 100% |

Sustainability Key Themes and Materiality Identification Process

MIRARTH HOLDINGS Group has identified materiality (key issues) and implemented measures to address them through the following process with the aim of contributing to a sustainable society and enhancing corporate value.

The Group contributes to the realization of a sustainable society and enhancement of corporate value by proactively addressing social issues.

-

step 1

Listing of Social Issues

We identified social issues from an environmental, social, and governance (ESG) perspective based on the analysis of ESG evaluation organizations and market trends.

-

step 2

Identification of Risks and Opportunities

We have clarified the risks and opportunities for MIRARTH HOLDINGS Group in each issue. Through this analysis, we have identified the challenges and opportunities that we may face in our business activities.

-

step 3

Identification of Stakeholder Impacts

We assessed how MIRARTH HOLDINGS Group will be affected by these issues and how the Group will affect them.

-

step 4

Assessment of Importance

Following discussions at workshops attended by the management of each Group company, we selected social issues of particular importance. These issues are directly related to the strategic decisions of MIRARTH HOLDINGS Group and have an impact on long-term corporate growth.

-

step 5

Examination of Measures

We examined measures to mitigate risks and expand opportunities for issues of high importance. Through workshops, specific action plans were developed, including technological innovation and business process improvements.

-

step 6

Identification of Materiality

Based on the above process, we identified and validated the materiality of MIRARTH HOLDINGS Group.

-

step 7

Establishment of KPIs

Based on the selected materiality, we set KPIs to measure specific results. This allows us to regularly evaluate the effectiveness of our measures and achieve sustainable growth. The contents of the materiality and targets/KPIs have been approved by the Sustainability Committee and are made public.