Corporate Governance

Basic Approach

The MIRARTH HOLDINGS Group has set "Our Purpose" as "To design sustainable environments for a happier future for both people and our planet." and recognizes that addressing issues related to sustainability is an important management issue. We will not only pursue profits, but also comply with laws, regulations, and corporate ethics, fulfill our social responsibilities as a member of the corporate community, and aim to sustainably enhance our corporate value.

To this end, our basic approach to corporate governance is to always consider the happiness of all stakeholders, including customers, employees, business partners, local communities, and shareholders, and to promote sound corporate activities by making decisions quickly and responding flexibly to changes in the business environment, as well as ensuring thorough compliance and transparency in decision making.

Initiatives to Strengthen Corporate Governance

| Details of Initiatives | |

|---|---|

| 2010 | Introduction of executive officer system |

| 2012 | Introduction of stock option plan for stock-based compensation for directors (excluding outside directors) and executive officers |

| 2016 | Start of evaluation of the effectiveness of the Board of Directors |

| 2017 | Term of office for directors changed from two years to one year |

| 2019 | Establishment of Nomination Committee and Compensation Committee |

| 2020 | Appointment of outside directors as chairpersons of the Nomination Committee and Compensation Committee |

| 2021 | Appointment of female outside directors |

| Ratio of outside directors increased to more than one-third (4 outside directors out of 12 directors) | |

| Revision of executive compensation system (introduction of non-financial indicators as evaluation items) | |

| 2022 | Disclosure of the skills matrix |

| Transition to a holding company structure |

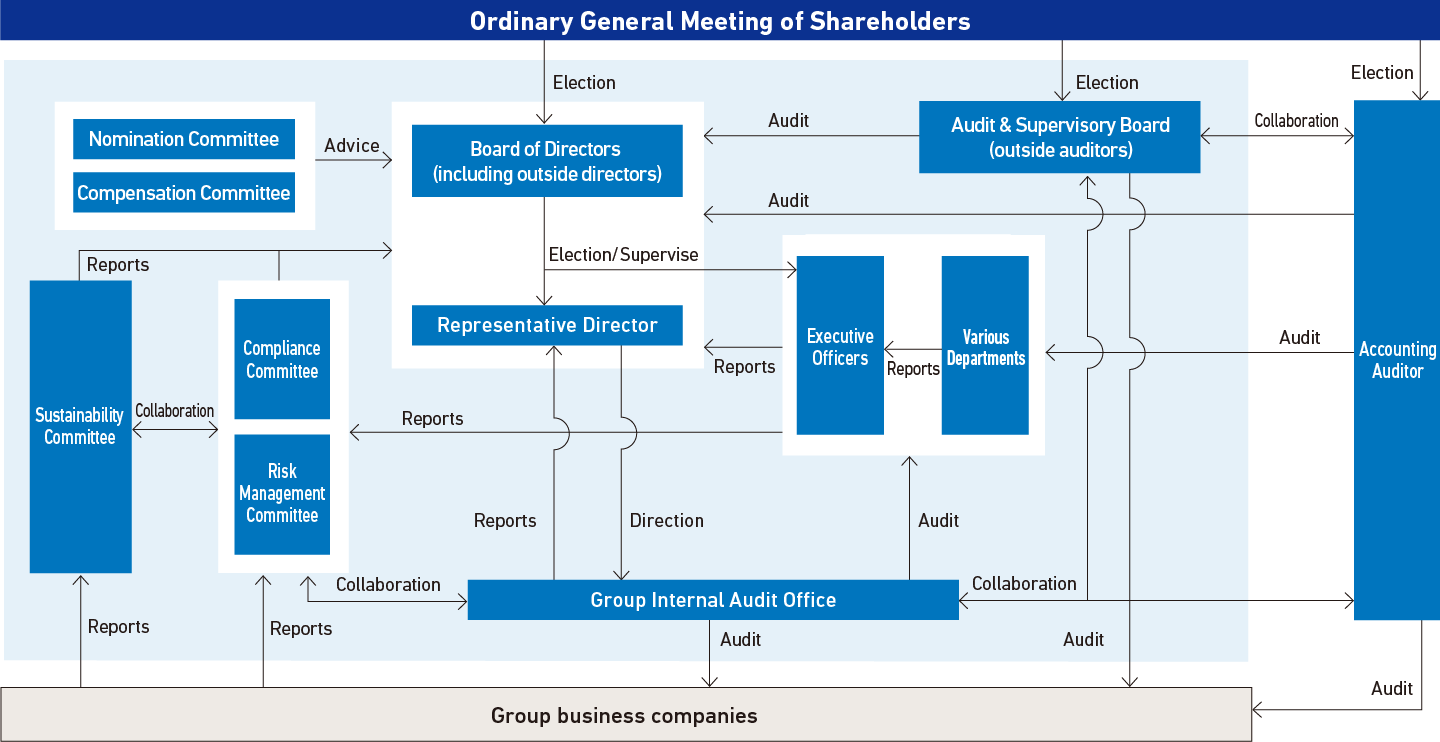

Corporate Governance System

MIRARTH HOLDINGS has established a system to ensure the appropriateness of management through careful and prompt decision-making by the Board of Directors, appropriate supervision of business execution by mutual directors, and auditing and supervision of business execution by directors by corporate auditors. In addition, the Company has adopted an executive officer system to clarify the management oversight responsibilities of directors and the business execution responsibilities of executive officers.

Corporate Governance System Trends

There are six directors, four of whom are independent outside directors with diverse backgrounds. The term of office of directors expires at the close of the ordinary general meeting of shareholders relating to the last fiscal year ending within one year after their election. 19 meetings of the Board of Directors were held in FY2022.

The Company has three corporate auditors, all of whom are independent outside corporate auditors, and has established a system that enables it to adequately fulfill its management oversight function from the outside. The Audit & Supervisory Board works to improve the level of auditing by sharing issues and information among the corporate auditors and requesting information from the Directors and various departments as necessary. The Board held 12 meetings in FY2022.

| Fiscal Year | Form of Organization | Total Number of Directors | Number of Outside Directors | Total Number of Auditors | Number of Outside Auditors |

|---|---|---|---|---|---|

| FY2016 | Company with Audit & Supervisory Board | 10 | 2 | 3 | 3 |

| FY2017 | Company with Audit & Supervisory Board | 10 | 3 | 3 | 3 |

| FY2018 | Company with Audit & Supervisory Board | 11 | 3 | 3 | 3 |

| FY2019 | Company with Audit & Supervisory Board | 13 | 3 | 3 | 3 |

| FY2020 | Company with Audit & Supervisory Board | 13 | 4 | 3 | 3 |

| FY2021 | Company with Audit & Supervisory Board | 12 | 4 | 3 | 3 |

| FY2022 | Company with Audit & Supervisory Board | 12 | 4 | 3 | 3 |

| FY2023 | Company with Audit & Supervisory Board | 6 | 4 | 3 | 3 |

- * Transferred to holding company structure as of October 1, 2022.

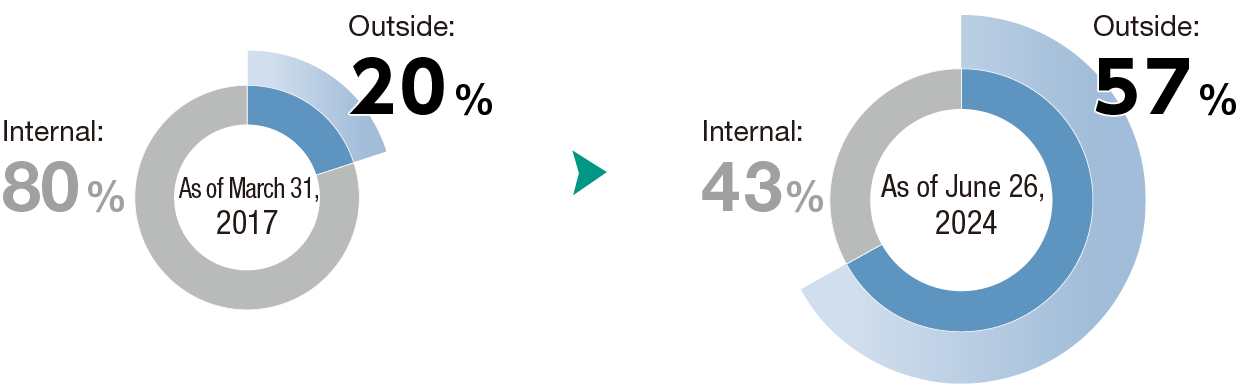

Ratio of Outside Directors on the Board of Directors

Board of Directors

MIRARTH HOLDINGS has six directors, four of whom are outside directors. All outside directors are designated as independent directors. In principle, the Board of Directors meets once a month. Extraordinary Board of Directors meetings are held as necessary to ensure decisions are made both carefully and promptly, and that directors mutually supervise each other's business execution.

Corporate auditors attend these meetings and provide their opinions when necessary. They also collaborate closely with outside directors to audit and oversee both the functioning of the Board and the status of business execution. Additionally, executive officers, the head of the Group Internal Audit Department, and leaders of other departments attend Board of Directors meetings when requested, in line with internal regulations. They provide opinions on agenda items and reported issues as appropriate.

Furthermore, the Company conducts a Group Management Committee meeting once a month. This meeting serves to discuss and deliberate on significant plans and proposals related to group management policies, strategies, and overall group governance, thereby refining the decision-making process.

Executive Officer System

The Company has introduced an executive officer system to clarify the management oversight responsibilities of directors and the business execution responsibilities of executive officers, and to further accelerate decision-making and strengthen business execution.

Audit & Supervisory Board

As a check and balance system for decision-making, all three corporate auditors are outside corporate auditors, and all of them have sufficient professional experience, track record, and attitude to make objective judgments and checks. In addition to audits of the Company, audits of affiliated companies are also conducted by attending meetings of each company's board of directors and conducting interviews with directors, thus maintaining a tense relationship. In addition, we work with the accounting auditor to understand and coordinate each other's annual schedules, accompany each other on site visits and model room inspections, and exchange information as needed to further improve the effectiveness and efficiency of our audits.

Group Internal Audit Office

In order to enhance and strengthen internal audits, the Company has established Internal Audit Regulations and established the Group Internal Audit Office as an independent organization reporting directly to the President. In planning and conducting internal audits, the schedule and content of audits are fully coordinated with those of corporate auditors and accounting auditors to ensure the efficient operation of each function. Corporate auditors strive to build an effective and efficient audit system by accompanying and attending operational audits conducted by the Group Internal Audit Office, confirming the content of the audits, and hearing opinions as appropriate.

Director Skills Matrix

In order to make objective judgments based on diverse knowledge and experience, the Company has identified the combination of knowledge, experience, and abilities that the Board of Directors should possess, as shown in the table below.

| Name | Position | Corporate Management | Finance/ Accounting |

Legal/ Risk Management |

Sales/ Marketing |

Human Resources/ Labor Relations |

IT | Global Business | Nominating Committee | Compensation Committee |

|---|---|---|---|---|---|---|---|---|---|---|

| Kazuichi Shimada | Representative Director Group CEO Group COO President and Chief Executive Officer |

◎ | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | |

| Masashi Yamamoto | Director Group CFO Managing Executive Officer |

◎ | 〇 | 〇 | ||||||

| Kenji Kawada | Outside Director | ◎ | 〇 | 〇 | 〇 | 〇 | Committee Chairman | 〇 | ||

| Chiaki Tsuji | Outside Director | ◎ | 〇 | 〇 | 〇 | |||||

| Keiko Yamahira | Outside Director | ◎ | 〇 | 〇 | 〇 | 〇 | 〇 | Committee Chairman | ||

| Naohito Yamagishi | Outside Director | ◎ | 〇 | 〇 | 〇 |

- * Each director has been given "◎" rating for items that he or she considers to be particular strengths.

Reasons for Appointment of Outside Directors and Number of Board Meetings Attended

Reasons for the appointment of each outside director and the number of board meetings attended in FY2022 are disclosed.

| Name | Position | Reason for Appointment | Year ending March 31, 2023 Attendance at Board of Directors Meetings |

|---|---|---|---|

| Kenji Kawada | Outside Director | He has been involved in management at financial institutions and business companies, and is appointed because of his extensive experience and track record in management, as well as his broad knowledge and insight. | 19/19 |

| Chiaki Tsuji | Outside Director | We have appointed her because of her expertise and extensive experience and achievements as a lawyer in Japan and Germany. | 19/19 |

| Keiko Yamahira | Outside Director | The appointment is based on her extensive experience and broad insight as a manager in the real estate industry. | 18/19 |

| Naohito Yamagishi | Outside Director | He was appointed because of his expertise and wealth of experience gained at the National Police Agency over a long period of time, as well as his track record and experience at the Ministry of Construction (currently the Ministry of Land, Infrastructure, Transport and Tourism). | 15/15 |

Nomination and Remuneration Committees

The Company has established the Nomination Committee and the Remuneration Committee as voluntary advisory bodies to enhance objectivity and transparency in the decision-making process regarding personnel matters and compensation of directors, etc., and to further enhance and strengthen the corporate governance system. Both committees are composed of at least three directors selected by resolution of the Board of Directors, at least half of whom are independent outside directors, thereby ensuring appropriate opportunities for involvement and advisory services by independent outside directors. Both committees, in consultation with the directors, deliberate and report primarily on the matters listed below.

Nomination Committee

- (1) Matters related to the composition and balance of the Board of Directors;

- (2) Matters related to the selection and dismissal of directors;

- (3) Matters related to the selection and dismissal of representative directors and executive officers;

- (4) Matters related to criteria for determining the independence of outside directors; and

- (5) Matters related to succession planning.

Remuneration Committee

- (1) Matters relating to the remuneration of directors and executive officers;

- (2) Matters relating to basic policies and criteria on the remuneration of directors and others; and

- (3) Other matters referred to the Remuneration Committee by the Board of Directors.

Evaluating the Effectiveness of the Board of Directors

In order to improve the functioning of the Board of Directors, we evaluate and analyze the effectiveness of the Board of Directors. With the cooperation of an outside consulting firm, we conducted an anonymous survey of all directors and corporate auditors, including outside directors. Based on the responses to the questionnaire, we analyze and evaluate the effectiveness of the Board of Directors. In addition, starting with the effectiveness evaluation in FY2022, the evaluation method was improved by conducting interviews based on the results of a questionnaire by an outside consulting organization.

The results of the questionnaire and interviews were generally positive, confirming that the Company's Board of Directors is functioning effectively to a considerable extent, but some issues were found regarding the nature of the Board of Directors and group governance after the Company's transformation into a holding company. In addition, the following issues, which had been identified as challenges in the previous effectiveness evaluation, were also identified as issues that need to be addressed for continued improvement: "Enhancement of discussions on management strategy, including the group-wide crisis management system and human capital investment," and "Reflection of shareholders' and other investors' opinions."

We will continue to fully consider issues and continue our efforts to improve the functioning of the Board of Directors.

Executive Remuneration

Directors’ remuneration is determined on the basis of the degree of each director’s contribution to business expansion and improvement in corporate value towards sustainable growth. The limit of the annual amount of remuneration is deemed to be ¥600 million (not including, however, the employee portion of the salary), and the limitation of the special stock option remuneration to ¥600 million annually is decided by a resolution at the Ordinary General Meeting of Shareholders. Auditors’ remuneration is limited to an annual amount of ¥60 million or less.