Corporate Governance

Basic Approach

MIRARTH HOLDINGS Group has set "Our Purpose" as "To design sustainable environments for a happier future for both people and our planet." and recognizes that addressing issues related to sustainability is an important management issue. We will not only pursue profits, but also comply with laws, regulations, corporate ethics, fulfill our social responsibilities as a member of the corporate community, and aim to sustainably enhance our corporate value.

To this end, our basic approach to corporate governance is to always consider the happiness of all stakeholders, including customers, employees, business partners, local communities, and shareholders, and to promote sound corporate activities by making decisions quickly and responding flexibly to changes in the business environment, as well as ensuring thorough compliance and transparency in decision making.

Initiatives to Strengthen Corporate Governance

| Details of Initiatives | |

|---|---|

| 2010 | Introduction of executive officer system |

| 2012 | Introduction of stock option plan for stock-based compensation for directors (excluding outside directors) and executive officers |

| 2016 | Start of evaluation of the effectiveness of the Board of Directors |

| 2017 | Term of office for directors changed from two years to one year |

| 2019 | Establishment of Nomination Committee and Compensation Committee |

| 2020 | Appointment of outside directors as chairpersons of the Nomination Committee and Compensation Committee |

| 2021 | Appointment of two female outside directors |

| Ratio of outside directors increased to one-third (4 outside directors out of 12 directors) | |

| Revision of executive compensation system (introduction of non-financial indicators as evaluation items) | |

| 2022 | Disclosure of the skills matrix |

| Transition to a holding company structure |

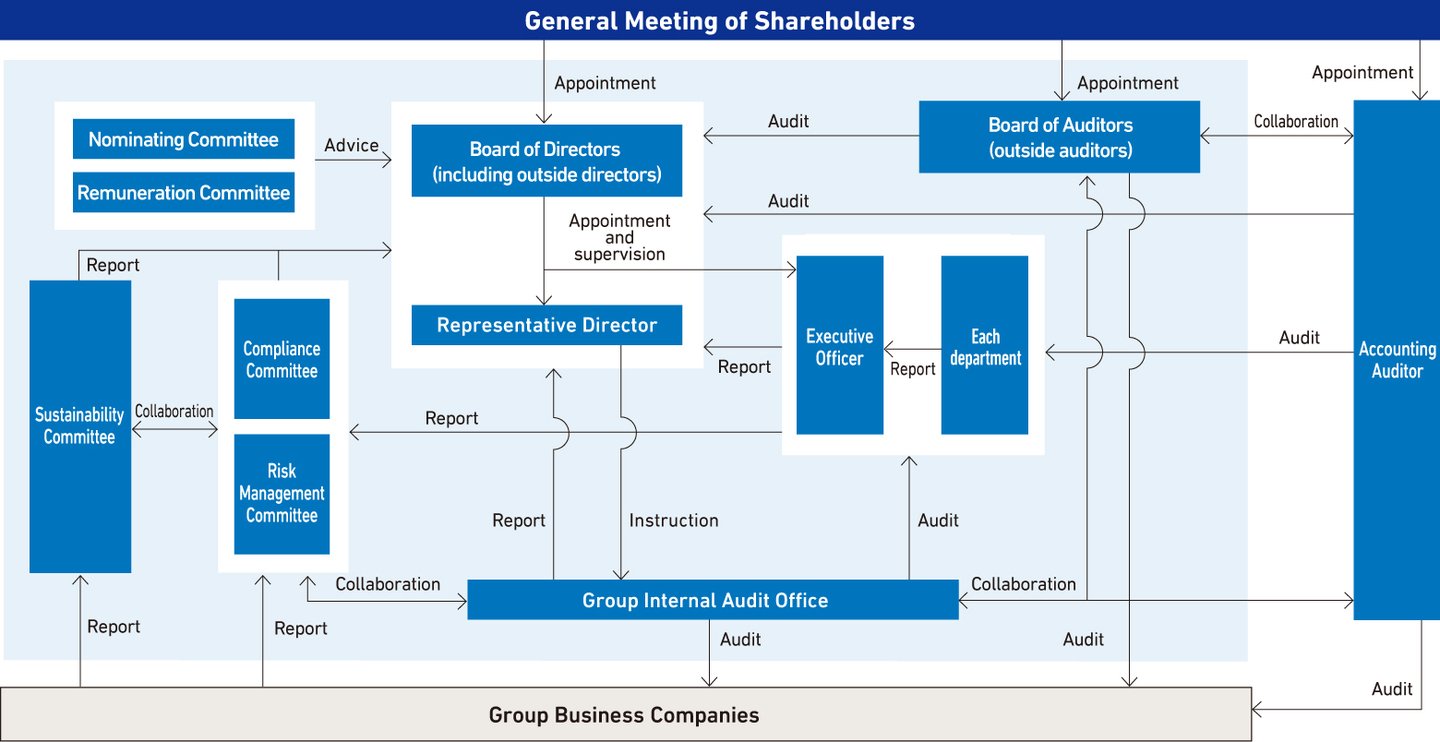

Corporate Governance System

MIRARTH HOLDINGS has established a system to ensure the appropriateness of management through careful and prompt decision-making by the Board of Directors, appropriate supervision of business execution by mutual directors, auditing and supervision of business execution by directors by corporate auditors. In addition, the Company has adopted an executive officer system to clarify the management oversight responsibilities of directors and the business execution responsibilities of executive officers.

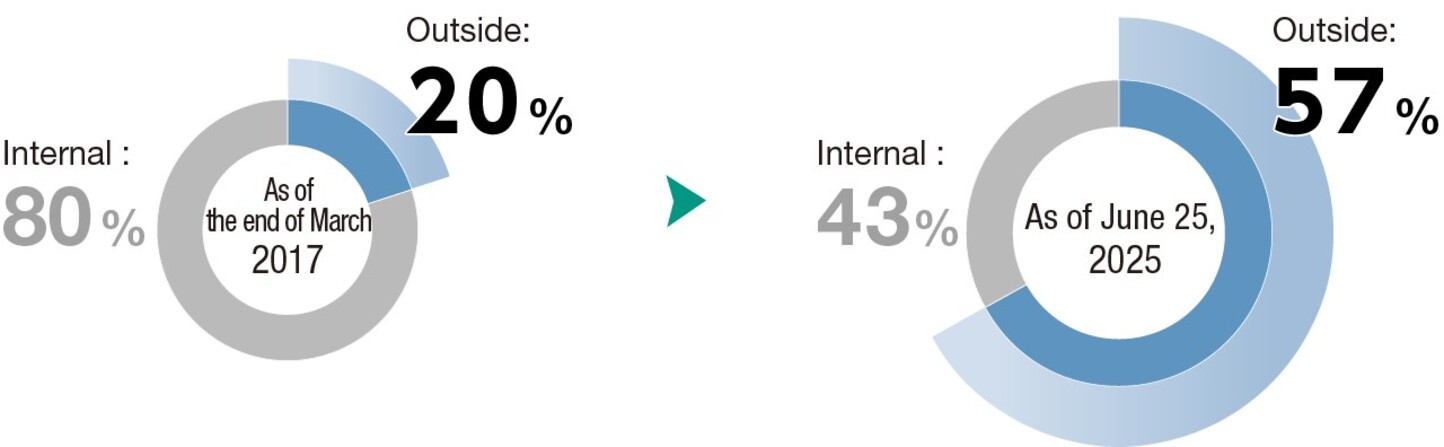

Corporate Governance System Trends

The Board of Directors consists of seven members, four of whom are independent outside directors with diverse backgrounds. Directors serve a term ending at the conclusion of the General Shareholders' Meeting for the final fiscal year ending within one year after their election. In FY2024, the Board of Directors convened 19 times.

The Board of Auditors consists of three members, all of whom are outside auditors, thereby establishing a framework that enables sufficient external oversight of management. The Board of Auditors shares issues and information among its members and, when necessary, requests information from directors and departments to enhance the quality of audits. In FY 2024, the Board of Auditors convened 12 times.

| Fiscal Year | Form of Organization | Total Number of Directors | Number of Outside Directors |

Total Number of Auditors | Number of Outside Auditors |

|---|---|---|---|---|---|

| FY2016 | Company with Board of Auditors | 10 | 2 | 3 | 3 |

| FY2017 | Company with Board of Auditors | 10 | 3 | 3 | 3 |

| FY2018 | Company with Board of Auditors | 11 | 3 | 3 | 3 |

| FY2019 | Company with Board of Auditors | 13 | 3 | 3 | 3 |

| FY2020 | Company with Board of Auditors | 13 | 4 | 3 | 3 |

| FY2021 | Company with Board of Auditors | 12 | 4 | 3 | 3 |

| FY2022 | Company with Board of Auditors | 12 | 4 | 3 | 3 |

| FY2023 | Company with Board of Auditors | 6 | 4 | 3 | 3 |

| FY2024 | Company with Board of Auditors | 7 | 4 | 3 | 3 |

| FY2025 | Company with Board of Auditors | 7 | 4 | 3 | 3 |

- * Transitioned to a holding company structure as of October 1, 2022.

Board of Directors

MIRARTH HOLDINGS has seven directors, four of whom are outside directors. All outside directors are designated as independent directors. In principle, the Board of Directors meets once a month. Extraordinary Board of Directors meetings are held as necessary to ensure decisions are made both carefully and promptly, and that directors mutually supervise each other's business execution.

Corporate auditors attend these meetings and provide their opinions when necessary. They also collaborate closely with outside directors to audit and oversee both the functioning of the Board and the status of business execution. Additionally, executive officers, the head of the Group Internal Audit Department, and leaders of other departments attend Board of Directors meetings when requested, in line with internal regulations. They provide opinions on agenda items and reported issues as appropriate.

Furthermore, the Company conducts a Group Management Committee meeting once a month. This meeting serves to discuss and deliberate on significant plans and proposals related to group management policies, strategies, and overall group governance, thereby refining the decision-making process.

Executive Officer System

The Company has introduced an executive officer system to clarify the management oversight responsibilities of directors and the business execution responsibilities of executive officers, and to further accelerate decision-making and strengthen business execution.

Audit & Supervisory Board

As a check and balance system for decision-making, all three corporate auditors are outside corporate auditors, and all of them have sufficient professional experience, track record, and attitude to make objective judgments and checks. In addition to audits of the Company, audits of affiliated companies are also conducted by attending meetings of each company's board of directors and conducting interviews with directors, thus maintaining a tense relationship. In addition, we work with the accounting auditor to understand and coordinate each other's annual schedules, accompany each other on site visits and model room inspections, and exchange information as needed to further improve the effectiveness and efficiency of our audits.

Group Internal Audit Office

In order to enhance and strengthen internal audits, the Company has established Internal Audit Regulations and established the Group Internal Audit Office as an independent organization reporting directly to the President. In planning and conducting internal audits, the schedule and content of audits are fully coordinated with those of corporate auditors and accounting auditors to ensure the efficient operation of each function. Corporate auditors strive to build an effective and efficient audit system by accompanying and attending operational audits conducted by the Group Internal Audit Office, confirming the content of the audits, and hearing opinions as appropriate.

Director Skills Matrix

In order to make objective judgments based on diverse knowledge and experience, the Company has identified the combination of knowledge, experience, and abilities that the Board of Directors should possess, as shown in the table below.

| Name Position |

Corporate Management |

Finance/

Accounting |

Legal Affairs/ Risk Management |

Sales/ Marketing |

Human Resources/

Labor Relations |

IT | Global Business |

Nominating Committee |

Compensation Committee |

|

|---|---|---|---|---|---|---|---|---|---|---|

| Kazuichi Shimada | ◎ | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | 〇 | ||

| Representative Director, Group CEO, Group COO, and President Executive Officer |

||||||||||

| Daisuke Nakamura | ◎ | 〇 | 〇 | |||||||

| Director, Group CFO, Senior Managing Executive Officer, and Manager of Office of Sustainability |

||||||||||

| Shoichi Akisawa | ◎ | 〇 | 〇 | 〇 | 〇 | |||||

| Director (Real Estate Segment Manager) |

||||||||||

| Naohito Yamagishi | ◎ | 〇 | Chairperson | 〇 | ||||||

| Outside Director | ||||||||||

| Kaname Uchida | ◎ | 〇 | 〇 | 〇 | Chairperson | |||||

| Outside Director | ||||||||||

| Yuko Kanamaru | ◎ | 〇 | 〇 | |||||||

| Outside Director | ||||||||||

| Yasuko Ono | 〇 | 〇 | ◎ | |||||||

| Outside Director |

- * "◎" indicates the items that each director particularly identifies as a strength.

Reasons for Appointment of Outside Directors and Number of Directors Meetings Attended

The reasons for the appointment of each outside director and the number of times they attended Board of Directors meetings in FY2024 are disclosed.

| Name | Position | Reasons for Appointment | Attendance at Board of Directors Meetings in FY2024 |

|---|---|---|---|

| Naohito Yamagishi | Outside Director | Appointed in recognition of the specialized knowledge and extensive experience cultivated over many years at the National Police Agency, as well as the track record and experience gained through duties at the Ministry of Construction (currently the Ministry of Land, Infrastructure, Transport and Tourism). | 19/19 meetings |

| Kaname Uchida | Outside Director | Appointed in recognition of extensive experience and broad insight in the real estate industry, as well as a proven track record and experience at the Ministry of Construction (currently the Ministry of Land, Infrastructure, Transport and Tourism). | 15/15 meetings * |

| Yuko Kanamaru | Outside Director | Appointed in recognition of holding legal qualifications in both Japan and the State of New York, and possessing specialized knowledge, extensive experience, and achievements gained both domestically and internationally. | 15/15 meetings * |

| Yasuko Ono | Outside Director | Appointed in recognition of direct involvement in company management, specialized knowledge and extensive experience gained at financial institutions both in Japan and overseas, as well as a proven track record and experience as an Auditor. | ― |

- * Based on the number of Directors meetings held in FY2024 after taking office on June 26, 2024.

Nomination and Remuneration Committees

The Company has established the Nomination Committee and the Remuneration Committee as voluntary advisory bodies to enhance objectivity and transparency in the decision-making process regarding personnel matters and compensation of directors, etc., and to further enhance and strengthen the corporate governance system.

Both committees are composed of at least three directors selected by resolution of the Board of Directors, at least half of whom are independent outside directors, thereby ensuring appropriate opportunities for involvement and advisory services by independent outside directors. Both committees, in consultation with the directors, deliberate and report primarily on the matters listed below.

Nomination Committee

- (1) Matters related to the composition and balance of the Board of Directors;

- (2) Matters related to the selection and dismissal of directors;

- (3) Matters related to the selection and dismissal of representative directors and executive officers;

- (4) Matters related to criteria for determining the independence of outside directors; and

- (5) Matters related to succession planning.

Remuneration Committee

- (1) Matters relating to the remuneration of directors and executive officers;

- (2) Matters relating to basic policies and criteria on the remuneration of directors and others; and

- (3) Other matters referred to the Remuneration Committee by the Board of Directors.

Executive Remuneration

Directors’ remuneration is determined on the basis of the degree of each director’s contribution to business expansion and improvement in corporate value towards sustainable growth. The limit of the annual amount of remuneration is deemed to be ¥600 million (not including, however, the employee portion of the salary), and the limitation of the special stock option remuneration to ¥600 million annually is decided by a resolution at the Ordinary General Meeting of Shareholders. Auditors’ remuneration is limited to an annual amount of ¥60 million or less.

Evaluating the Effectiveness of the Board of Directors

To enhance the functions of the Board of Directors, we conduct evaluations and analyses of its effectiveness. With the support of an external consulting firm, we administer anonymous questionnaires to all directors, including outside directors, as well as to auditors. Based on the responses to these questionnaires, we analyze and evaluate the effectiveness of the Board.

In the effectiveness evaluation for FY2024, interviews were also conducted with all directors and auditors, based on the results of the external consulting firm's questionnaire. A third-party evaluation report was subsequently received.

The results of this year's questionnaire and interviews indicated that the composition, operation, and discussions of the Board of Directors received a generally positive assessment, confirming that the Board is functioning with a considerable degree of effectiveness. At the same time, areas requiring improvement were also identified. These include enriching discussions to further enhance the supervisory functions as a holding company, particularly in relation to medium- to long-term strategy formulation and the reinforcement of group governance.

We will continue to fully examine the identified issues and steadily pursue initiatives to further enhance the functions of the Board of Directors.